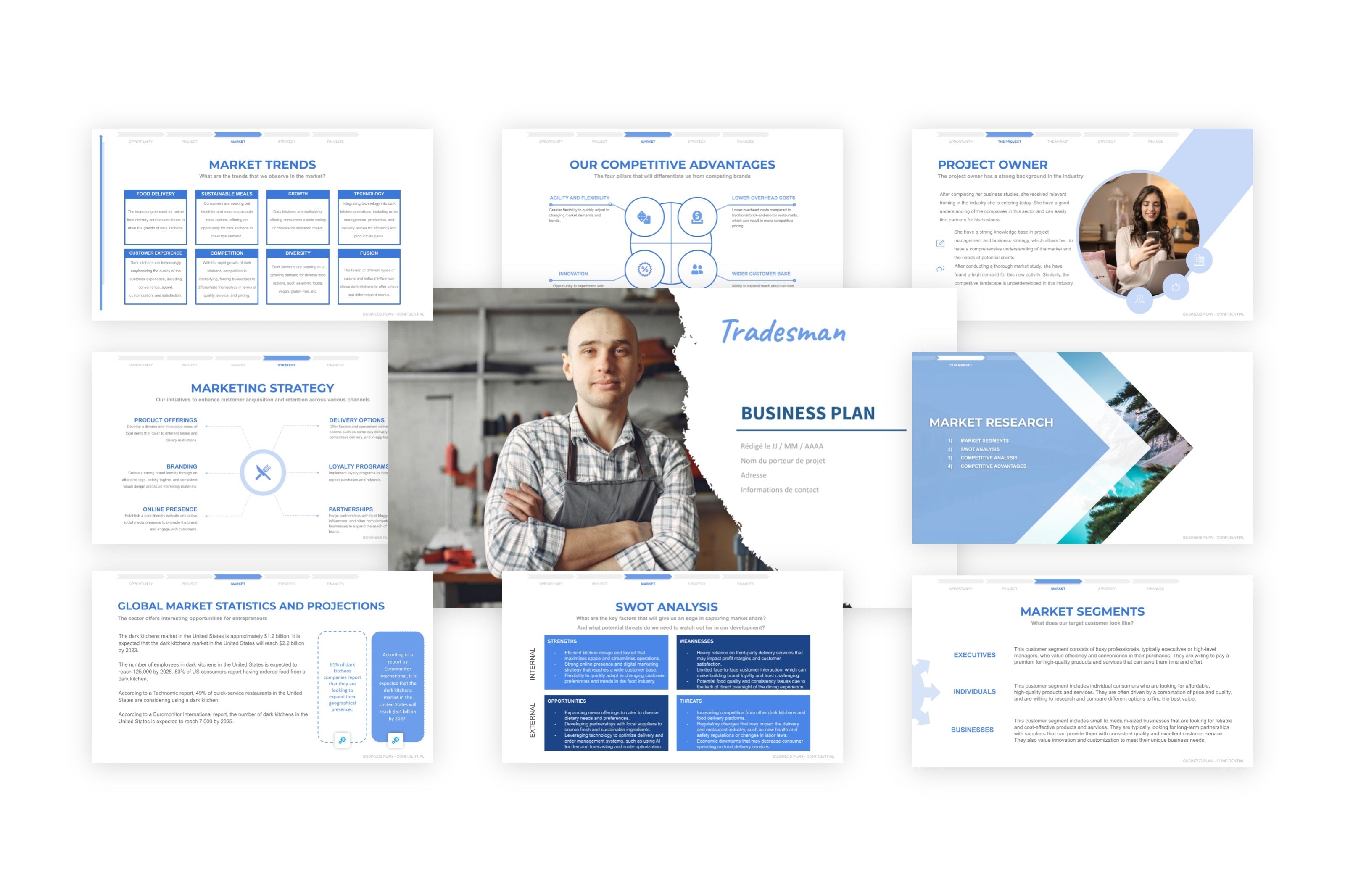

Tradesman Business Plan

- Complete business plan, fully customizable

- Business plan complet et modifiable

- Suitable for a funding request

- 35 pages written by our team

- 80 hours of research and analysis

- All techniques and strategies to succeed

- Updated every semester

- Guidance by our experts for free

- Accompagnement par nos experts : gratuit

- Receive future updates for free

After your purchase, you will receive the document directly by email.

Question?

CONTACT THE TEAMYes, you need a business plan 📝 🏆

It's not an expense, it's an investment

3 times

more likely to obtain funds for your project

+70%

of revenue earned, on average, in the first year

5 times

more likely to survive after three years of operation

23

people, who make up a team of experts, offer you personalized guidance

If you want to:

- Have a team of experts by your side

- Know your future revenues

- Get all the data about your market

- Earn revenue from the first month

- Anticipate and manage all the risks

- Get your financing 💸💸

- Perfectly manage your cash flow

- Succeed in your project

Question?

CONTACT THE TEAMAccess over 80 hours of research, analysis, writing, and formatting

Don't start from a blank slate ⛔

Writing a business plan can be lengthy and challenging, especially for beginners.

Starting from scratch requires hours of research, writing, structuring, and formatting.

Another alternative is to take advantage of our experts' work and complete a business plan that is already 80% pre-written.

The most up-to-date market data is available. Everything is already structured, written, analyzed, and formatted.

All you have to do is personalize it with your company name, logo, your own photos (optional), and some specific data related to your project only.

Steps to make a business plan

What we have done

What is left for you

Market data and industry trends

6 hours

6 hours

Market Research

18 hours

18 hours

Knowledge from with business owners

12 hours

12 hours

Compilation of results and data collected

6 hours

6 hours

Structuring the business plan

4 hours

4 hours

Writing paragraphs

4 hours

4 hours

Financial formulas, analysis, and calculations

4 hours

4 hours

Formatting

4 hours

4 hours

Tailoring the business plan with your personal information

Less than an hour ✅

If you want to:

- Anticipate all your future expenses

- Elaborate a winning strategy

- Win over a banker or an investor

- Get unrestricted access to our experts

- Launch a highly profitable business quickly

Unlimited access to 23 experts

We are a team of analysts, researchers, and financiers who have been writing business plans for entrepreneurs for over 12 years.

Throughout our experience, we have read countless market and sector studies, allowing us to have a deep understanding of your industry. We stay connected with market leaders to stay up-to-date with the latest trends and insights.

Having created more than 2,000 customized business plans, we have identified an opportunity to provide our clients with something of higher quality and at a reduced cost. We now offer fully editable documents that can be easily customized to meet your specific needs.

To ensure the best results, we engaged in extensive discussions with each of the entrepreneurs we supported. We tailored each document based on their desires and requirements, continuously revising them until they perfectly aligned with the vision of each business creator.

Today, we are proud to announce that our platform, dojobusiness.com, hosts a wide range of templates for over 250 different activities.

However, our commitment doesn't end with preparing and updating documents. We are here for you every step of the way.

Whether you have questions, need advice, or require assistance with refining your business plans or market studies, we are readily available.

And the best part? Our support and guidance are completely free!

Remember, we are dedicated to being there for you, offering unwavering support as you navigate the path of entrepreneurship

If you have any inquiries, please don't hesitate to reach out to us.

Questions?

Now, it's your turn to succeed! ✊

Like thousands of others before you, take every opportunity to set yourself up for success in your new project.

Our business plans and documents are tailored for individuals like you who aspire to succeed but may lack the necessary resources.

By purchasing a business plan, you greatly enhance your chances of building a profitable project.

Rest assured, we are committed to standing by your side, providing support and guidance throughout your project. ❤️

Question?

CONTACT THE TEAM