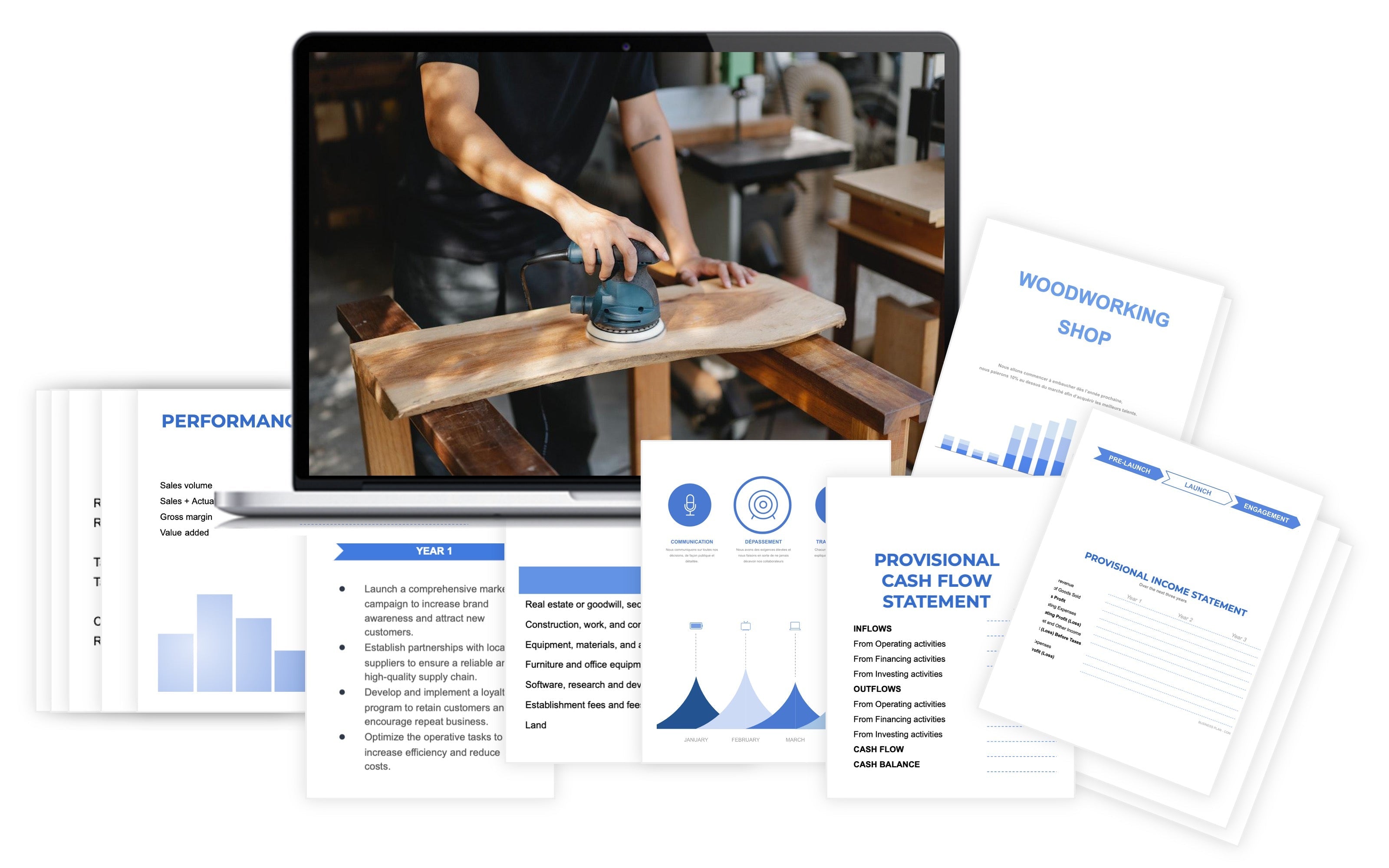

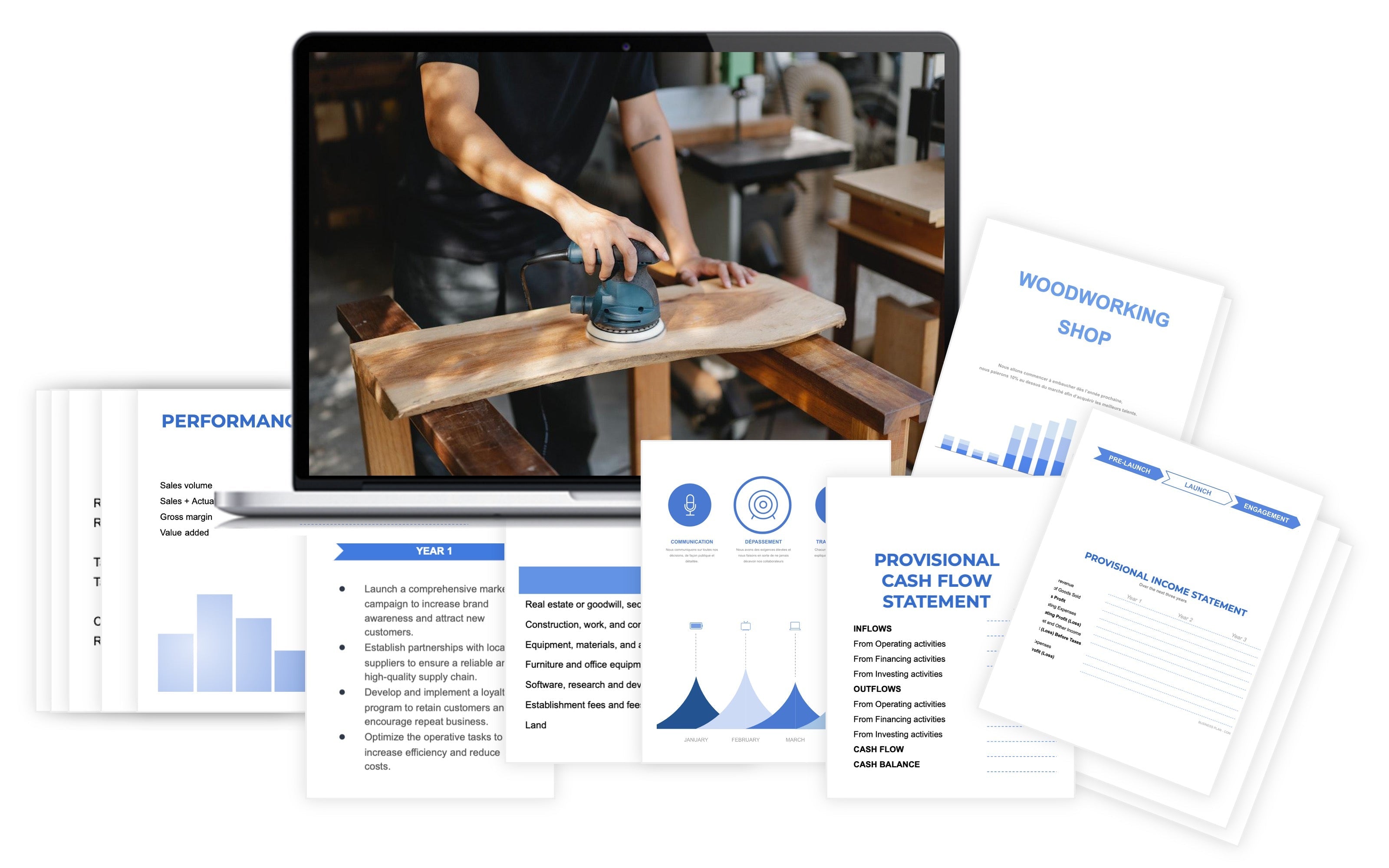

Woodworking Shop Financial Plan

- Your financial projections for 3 years

- All financial tables and ratios

- Data already filled

- The complete list of expenses

- Break-even analysis

- Compatible with a loan application

- Suitable for beginners (fully guided)

- No financial knowledge required

- Support from our experts: free of charge

After your purchase, you will receive the document directly by email.

One question?

CONTACT THE TEAMBecome confident with figures📝 🏆

Easily and rapidly gain a complete understanding of your financial situation

Unlimited support from our team of 23 experts

We are a team of analysts, researchers, and financiers. For over 12 years, we have been writing business plans for entrepreneurs.

We have read hundreds and hundreds of market and sector studies.

We know the industry you are entering and we are in touch with market leaders.

After creating more than 2,000 customized business plans, we realized that we could offer something of better quality and at a lower cost to our clients: fully editable documents to be completed.

We spoke with each of the entrepreneurs we had supported. We built each document based on their desires and needs. We revised them until they were a perfect fit for each business creator.

A few years later, we now have a platform with templates for over 250 different activities: dojobusiness.com.

We don't just prepare and update documents; our support goes beyond that!

We are here for you every day, providing answers to your questions, giving advice, and reviewing your business plans and market studies without any charge!

We are committed to being there for you whenever you need us ❤️

If you have any questions, feel free to reach out to us.

Any questions?

Now, it's your turn to succeed! ✊

We understand that you may not enjoy dealing with figures, finance, and accounting.

However, having a financial perspective of your project before starting is essential.

Would it be wise to launch a project without knowing your starting budget, anticipating future revenues, being aware of future expenses, or understanding the profitability potential of your project?

Download this financial projection and, like 7,000 other entrepreneurs before you, give yourself the best chance to succeed in this new project you are undertaking.

Our financial projections are designed for people like you who want to succeed but may not always have the necessary resources to do so.

By working on your future finances, you significantly increase your chances of building a profitable project.

We promise to stay by your side, offering guidance and support throughout the duration of your project ❤️

One question?

CONTACT THE TEAM